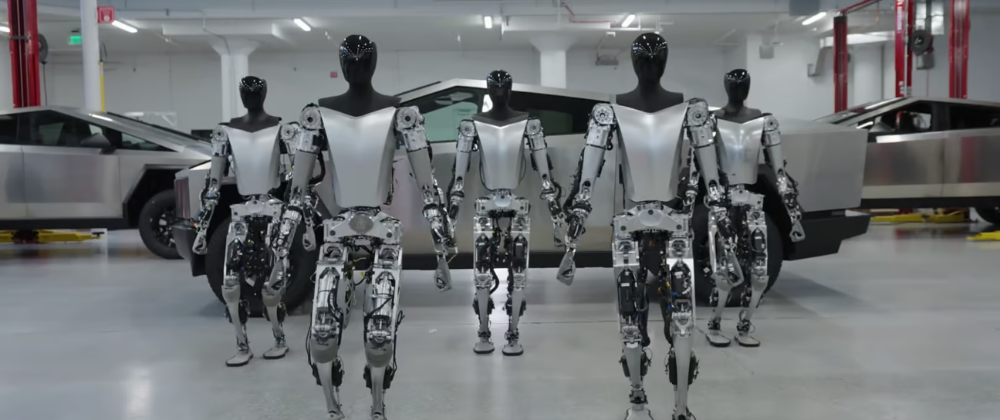

In a recent move that has caught the attention of investors, Tesla CEO Elon Musk has teased the potential of [humanoid robots](

) to significantly boost the company's market capitalization to a staggering $25 trillion. While Musk's claim may be met with skepticism, it has nonetheless highlighted the growing importance of the robotics sector and the opportunities it presents for investors.

The robotics ecosystem has seen substantial growth in recent years, with a global valuation of $72.17 billion in 2022. According to Precedence Research, the sector is expected to reach $283.19 billion by 2032, implying a compound annual growth rate (CAGR) of 14.7%. This growth trajectory underscores the potential for investors to capitalize on the robotics boom.

In light of Musk's teaser, InvestorPlace has identified three compelling robotics stocks to consider: Rockwell Automation (ROK), Zebra Technologies (ZBRA), and Teradyne (TER).

Rockwell Automation, a global leader in industrial automation and information technology, provides hardware and software solutions that help companies optimize their manufacturing processes. The company's expertise in industrial automation can lead to significant productivity gains for enterprises. While ROK stock has faced some challenges, with a decline of over 10% since the beginning of the year, analysts anticipate a turnaround in fiscal 2025, with an expected 18.33% jump in earnings per share (EPS) to $12.01 and a 5.7% increase in sales to $9.09 billion.

Zebra Technologies, a communication equipment company based in Lincolnshire, Illinois, offers enterprise asset intelligence solutions in the automatic identification and data capture industries. Its vast acumen in areas such as mobile computing and RFID technology makes it a valuable complement to advanced robots for enhanced productivity. Zebra's financial performance has been solid, with an average EPS of $2.18 in the past four quarters, beating the analysts' consensus view by almost 7%. Analysts expect Zebra's EPS to grow by 22% to $11.97 in fiscal 2024, with sales projected to reach $4.77 billion, up 4.2%.

Teradyne, a semiconductor equipment and materials company, is considered one of the most important players in the robotics stock market. The company designs, develops, manufactures, and sells automated test systems and robotic products worldwide, with a focus on providing flexible and safe automated solutions for manufacturing tasks. While Teradyne's valuation premiums are high, with shares trading at 60.5X earnings and almost 10X sales, analysts see progressive growth in fiscal 2024 and 2025. By 2025, EPS could rise to $4.83, and the top line could reach $3.4 billion, a significant improvement over 2023's results.

In conclusion, Elon Musk's teaser of the Tesla Bot has sparked renewed interest in the robotics sector, and investors are looking to capitalize on the growth opportunities it presents. The three robotics stocks highlighted in this article—Rockwell Automation, Zebra Technologies, and Teradyne—offer diverse investment opportunities in the rapidly evolving robotics ecosystem.

Oldest comments (0)